Are you on the hunt for finding the best PayPal alternatives in India for domestic payments?

If so then you have arrived at the right blog post.

Not long ago, PayPal announced that they are shutting down domestic payment services in India from 1st April 2021.

Meaning, if you are an Indian business owner, agency, eCommerce store owner, or simply a freelancer who collects payments from your Indian customers & clients using PayPal, you won’t be able to do so from 1st April.

Hence finding a reliable alternative to PayPal that would allow you to collect online payments in India is the only option left.

With a lot of option payment solutions available, we have narrowed it down to the 5 best alternative solutions.

Here’s an…

Overview Of PayPal Alternatives In India

| Payment Services | Fees & Charges |

|---|---|

| Payoneer | Free for Payoneer to Payoneer accounts. 3% per transaction fee if payment is made by credit card |

| Razorpay | 2% + GST for domestic cards 3% + GST for international cards |

| PayU | 2% + GST for domestic cards 3% + GST for international cards |

| Stripe | 2% + GST for domestic cards 3% + GST for international cards |

| Instamojo | 2% + INR 3 + GST for domestic transactions |

Before we start exploring each of them in detail, allow me to briefly talk about PayPal. And, why you, as an Indian PayPal user must look for its alternative.

What Is PayPal?

PayPal is an online payment solution that easily & safely sends and receives money between two parties.

If you are a merchant, PayPal allows you to collect international as well as domestic payments. PayPal has played a significant role in the globalization of several businesses.

In addition to this, if you are a customer, PayPal safely saves your payment details like account number, credit/debit card details, etc. so that you don’t have to type in every time you make a transaction.

You should be assured to know that PayPal doesn’t share any payment details with the vendor. It acts as an unbiased middleman for safer and fair transactions.

Key Characteristics Of PayPal

- PayPal is available in almost 200 countries.

- It supports 26 global currencies for transactions.

- It can also be used as a payment gateway and processor.

- You have the flexibility to collect recurring payments via PayPal.

- Managing transactions, refunds, invoicing, etc. is possible in PayPal.

- PayPal can be easily integrated with your website and software.

Fees & Pricing Of PayPal

Just like most of the online payment solutions, PayPal doesn’t charge any fees for signing up. It is 100% free.

Although, it would charge you a transaction fee (depending on the country) for sending or receiving money.

For instance, if you are a seller in India, you’d incur 2.5%* + a fixed fee of INR 3 for every domestic payment. Similarly, for receiving international payments, you’d be charged 3.4 – 4.4% + fixed fee. Not to mention, there’s an additional currency conversion fee as well.

With that being said, now you are wondering…

Why Do We Need To Find Suitable PayPal Alternatives In India?

Being a PayPal user in India, you may face a lot of problems with PayPal.

Here are some of the latest and most common demerits of PayPal –

- As I have said earlier, PayPal will be shutting down its domestic payment services in India. You would not be able to collect payments from an Indian user anymore with PayPal.

- The transaction fee of PayPal is very hefty when compared with other payment solutions. If you receive a large number of payments, you’d incur more and more transaction fees.

- PayPal also has a very bad reputation when it comes to receiving international payments. The currency conversion rate is very poor as compared to other online payment services.

- In the case of chargebacks or disputes, PayPal charges you a hefty fee.

- PayPal is also notoriously famous for freezing the account of its users without any warning. When your account is frozen, you will not be able to withdraw funds to your bank account, and neither will you be able to send money to someone else.

- If you don’t have a representative assigned to your business by PayPal, it would be very slow and tedious to seek customer support.

Apart from these, I presume that you’d be having your own personal reasons as well.

Now that you have realized that finding reliable alternatives to PayPal in India is the only logical option left, we jump straight to exploring all the replacement options in detail.

Let’s start with my personal favorite –

1. Payoneer

Payoneer was launched way back in 2005 and since then it has developed to become a leading online payment service. This payment processor grew so much in popularity and user base that it started giving a tough competition to PayPal. You’d be amazed to know that it is used by 4 million customers from 200+ countries to receive & send payments in 150 currencies.

But since we are focusing on Indian users, I would like to assure you that Payoneer is the best PayPal alternative to receive money in India. Payoneer resumed its payment services in India in 2016 and after that, it became the most favorable means to collect payments. A majority of freelancers, IT companies, agencies, and business owners prefer Payoneer over PayPal.

What Makes Payoneer The Best PayPal Alternative In India?

- Payoneer charges significantly lesser transaction fees than PayPal for domestic as well as international payments. You’d be amazed to know that you’d only incur a 3% fee on credit card payments for all currencies. Also if you receive money in USD, EUR, GBP, or JPY via another Payoneer account, you would not incur any charges.

- The currency conversion rate in Payoneer is comparatively better than that in PayPal. At the moment, the currency is converted at the rate of 2% above the market rate, at the time of transaction.

- Payoneer offers you the means to automatically withdraw funds in your bank account on a daily, weekly, and monthly basis.

- If you are a freelancer, you’d be relieved to know that a lot of marketplaces and networks like Fiverr, 99Designs, iStock, Upwork, etc. support payments via Payoneer.

Payoneer Fees & Charges

Being an ideal substitute for PayPal, Payoneer allows you to sign up for its payment services for free. Meaning, you could create an account and add your bank account without paying any fees.

That’s not all. In fact, you can also receive money from another Payoneer account without incurring any fees. In addition to this, Payoneer also offers a unique feature called receiving account where you will be given local receiving accounts in USD, EUR, GBP, JPY, CAD, AUD & MXN. If you receive money via receiving accounts even then you won’t be charged any transaction fee.

However, if you receive payments via credit cards (through Payoneer payment gateway), you’d incur a 3% transaction fee on all currencies.

Additionally, while withdrawing funds to your bank account, you’d incur up to 2% currency conversion charges if you have received international payments.

2. Razorpay

Having started in 2013 by alumni of prestigious IIT Roorkee, Razorpay has grown to become the best payment gateway for online payments in India. It’s amazing to know that over 500,000 businesses and freelancers in India are relying on Razorpay to collect payments. Some of the most notable clients of Razorpay are SpiceJet, Swiggy, PizzaHut, Nykaa, BookMyShow, Unacademy, etc.

The reason behind this huge growth and popularity of Razorpay is its multitude of products. From collecting one-time payments to subscription billing, sending invoices & collecting freelancer payments, Razorpay is capable of doing it all. Hence, it naturally qualifies to be one of the top alternatives of PayPal in India.

What Makes Razorpay The Best PayPal Alternative In India?

- If you are a business owner who is looking to collect payments from its Indian customers through its website, you can choose Razorpay as your payment gateway. It is very easy to integrate with your website.

- To facilitate seamless payment collection, Razorpay enables you to create and send payment links to your existing customers. All you need to do is enter the amount, customer’s details (name & email), and send it via an SMS or an email.

- Razorpay is pretty serious when it comes to maintaining your business brand. Therefore, it allows you to create custom-branded payment pages. These pages and other modes of payments also permit you to collect recurring payments.

- Besides all the conventional online payment methods, Razorpay also supports payment collection via UPI, NEFT, RTGS, IMPS, etc. Rest assured, Razorpay has a good reputation with a lot of Indian banks.

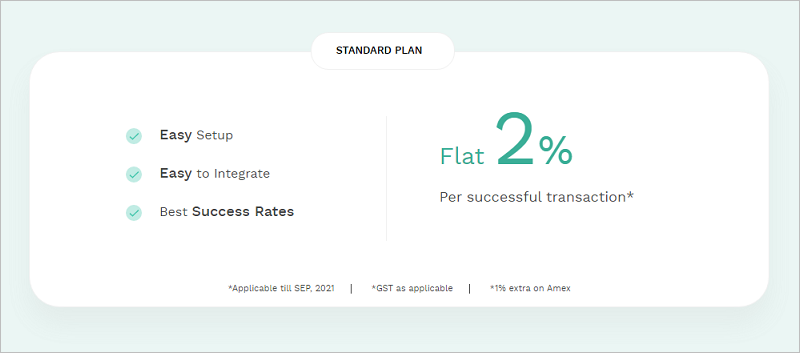

Razorpay Fees & Charges

Razorpay is a cheaper alternative of PayPal in India. Just like PayPal, Razorpay does not have any setup fee and allows you to sign up for free.

Once you sign up, you are automatically subscribed to its Startup plan. In this plan, you can use Razorpay free of cost for the period of 3 months or collect up to INR 300,000 (whichever comes first).

After this period, you’d have to pay a Razorpay platform fee of 2% for every domestic transaction. Additionally, for international payments and business credit cards, you’d incur 3% per transaction fee.

3. PayU

PayU is yet another leading payment gateway for Indian businesses and customers. It was started in 2011 and since then it has grown to the point where it offers safer payment processing services to 450,000+ businesses. The best part about PayU is that it favors businesses of all kinds like home businesses, physical stores, as well as eCommerce businesses.

Even if you are a freelancer, you can avail of payment collection services of PayU. Simply because it offers 100+ payment options. Therefore, with so many features available in PayU, it’s safe to say that PayU is one of the best Indian PayPal alternatives.

What Makes PayU The Best PayPal Alternative In India?

- Being a prominent payment gateway for businesses, it easily integrates with your business website or eCommerce store. Speaking about integration, it offers an extensive library of APIs, documentation, and test environment.

- If you have a physical store, PayU issues BharatQR i.e. a QR code using which your customers can scan and make the payment easily. This also means that PayU supports all the major UPIs in India.

- PayU offers a unique feature in the form of an MS Excel plugin. This plugin empowers you to accept payments from excel sheets. Apart from this, if you like conventional payment methods, PayU also enables you to create and send GST-compliant invoices to your customers.

- Just like other substitutes to PayPal, PayU also enables you to accept payments through payment links. You can effortlessly create these links and share them via WhatsApp, Facebook, SMS, emails, etc.

PayU Fees & Charges

Just like other PayPal alternatives to receive money in India, PayU allows you to get started by creating an account for free.

However, when it comes to fees, PayU charges you 2% + GST for every domestic transaction made by debit cards, credit cards, net banking, QR code, wallets, etc.

Besides this, for international transactions and American Express cards, you would be charged 3% + GST per transaction.

4. Stripe

Stripe is one such online payment service that could compete against PayPal for international payment transfers. Not just this, but Stripe also functions as one of the best PayPal alternatives for freelancers and businesses in India.

This payment solution was not available to Indian users earlier. In order to use it, Indian users must have an overseas account, preferably in the United States. But in December 2017, Stripe was launched in India making it easier to send and receive payments domestically.

What Makes Stripe The Best PayPal Alternative In India?

- It allows you to collect one-time as well as recurring payments from your customers or clients. It acts as an ideal payment gateway for all kinds of businesses and services.

- Being a business owner, you’d want to expand the ways in which you can get paid. Hence, Stripe offers seamless integration with your website, mobile apps, and software.

- Just like other alternatives for PayPal, Stripe also facilitates payment collection via invoices. The invoices are customizable and can include required taxes.

- All in all, Stripe supports payment collection in multiple ways. Some of the most common methods include payment via debit cards, credit cards, wallets, direct bank debits, and transfers, etc.

Stripe Fees & Charges

Stripe, being a perfect alternative to PayPal, also enables you to create an account for free. Moreover, there are no set up fees or any kind of hidden fees in Stripe. You only pay for what you use.

Speaking of which, for every transaction, you’d have to pay 2% if the payment is made by the card (credit or debit) that is issued in India. Similarly, payments by the cards issued outside India would charge you a transaction fee of 3%.

Please note that the above-mentioned transaction fee excludes GST. Also, there’s an additional fee of 2% for currency conversion.

5. Instamojo

Until now, we have discussed some conventional payment sending and receiving services. But when it comes to Instamojo it is something more than that. You’d be amazed to know that it is a payment gateway and an online store builder for Indian businesses, marketers, agencies, and freelancers.

It’s astonishing that despite being limited to the Indian audience, Instamojo has a clientele of more than 1,500,000 users. And, because of its dual nature and functionality, it becomes one of the top PayPal alternatives for Indian users.

What Makes Instamojo The Best PayPal Alternative In India?

- If you are just starting out, Instamojo allows you to create an online store, get a domain & professional email address. In addition to this, you get to collect payments for your products in a single dashboard.

- Just like PayPal, Instamojo also acts as a payment gateway. Meaning, it can be easily integrated with your website by embedding payment buttons wherever necessary.

- Additionally, if you classify yourself as a freelancer or a service provider, you can request payment through payment links. These links can be easily created and shared via Whatsapp, social media, emails, etc.

- Instamojo offers 100+ methods for collecting payments in India. Some of the most essential methods supported are domestic debit/credit cards, UPI payments, net banking, wallets, NEFT, RTGS, bank transfer, etc.

Instamojo Fees & Charges

Instamojo doesn’t fail to impress when it comes to pricing and transaction fee. To start things off, it offers a free sign-up.

After signing up, Instamojo has a separate fee structure for payment gateway and online store.

For just receiving payments on Instamojo via any domestic payment methods, you will be charged 2% + INR 3 (excludes GST) for every transaction. For receiving payments via international cards, you’d be charged 3% + INR 3 per transaction.

Similarly, you can start using the online store for free but the transaction charge is higher i.e. 5% + INR 3 (excludes GST). There are four subscription plans for the online store and the highest plan (Growth) would lower the transaction fee to 2% + INR 3.

Final Verdict – What Is The Best Alternative To PayPal?

Now that you have explored all the best PayPal alternatives in India, it’s time for you to make the switch.

Hopefully, you have found a decent substitute for PayPal by now.

If not then allow me to recommend you Payoneer. This payment gateway & processor is by far the best in terms of features and service. Not to forget, Payoneer is also lenient and doesn’t abruptly ban your account like PayPal.

Another reason that gives Payoneer an edge over other options is its ability to transfer money internationally with competitive currency conversion rates.

Although, if you purely have Indian customers and clients, Razorpay would do just fine.

Lastly, here are a couple of relevant blog posts that you should check out –