Are you looking for the best Payoneer alternatives to collect international payments?

If so then you are at the right place.

Since the majority of businesses are choosing the digital mode of conducting businesses, online payment systems have become an absolute necessity.

No matter if you are a freelancer, an agency, an eCommerce store owner, or any other kind of business, you must have an online payment system to send and receive payments.

Keeping the recent situations in mind, I think Payoneer rose up to the occasion and became a stape online payment collection/sending platform.

Not only it is easy to use and free to start with but the currency exchange rate is also very cheap. That’s why many freelancers have started using Payoneer.

Although, you should know that a good share of business owners do not prefer using Payoneer.

Hence, you should have some decent Payoneer alternatives in your arsenal so that you can use them as a replacement for Payoneer and collect payments.

Before I uncover all the best options, I would like to briefly shed some light on Payoneer.

What Is Payoneer And How Does It Work?

Payoneer was launched way back in 2005. Ever since its launch, the team behind it worked vigorously to bring it to the level that it is today.

Yes, Payoneer is considered to be one of the best international payment collection and sending platforms.

“Why”, you ask?

Simply because it supports 150+ currencies and works in 200+ countries. In addition to this, Payoneer will help you create local receiving accounts in USD, EUR, GBP, JPY, CAD, AUD, and MXN.

Talking about its working, Payoneer allows you to receive or send money to anyone in the world (provided they have a Payoneer account as well). You can also send invoices, track & manage your transactions, withdrawals, etc. in your Payoneer account.

The best part about Payoneer is that if you are receiving money in USD, EUR, GBP, and JPY from Payoneer to Payoneer, no fees will be charged. And, not to forget, the forex conversion is also very good.

Now you would be wondering if Payoneer is so awesome, why do we need other alternatives to Payoneer?

Well, believe it or not, apart from its heaping pile of positive characteristics, Payoneer has a few drawbacks as well.

Why Do We Need Payoneer Alternatives? (Drawbacks Of Payoneer)

- First and foremost, many businesses and freelancers still do not trust Payoneer for sending or receiving payments.

- You can withdraw funds only if you have $100 available in your Payoneer account. If the amount is less than $100, you’d have to wait for it to reach that point.

- It would only allow receiving and sending money from one Payoneer account to another Payoneer account. Payoneer to PayPal, Stripe, etc. is not possible.

- Payoneer does not support recurring payments if you or your business is located outside of the USA.

- You will be charged 3% of the transaction amount if it is made by a credit card.

I hope that by now, you have realized that finding reliable alternatives to Payoneer will only strengthen and streamline your international payment collection process.

That being said, it’s time for us to explore all the alternatives in detail…

1. PayPal

PayPal is literally the synonym for online payment transfer. Hence, PayPal rightfully deserves to be featured at the top as the best alternative to Payoneer.

In addition to just being a payment transfer platform, PayPal also works as a payment processor or gateway for online transactions. A lot of businesses use PayPal’s API and gateway to collect payments from their customers.

What Makes PayPal The Best Alternative?

- With extreme efficiency and ease, PayPal facilitates recurring payments. So you can easily sell subscriptions or receive recurring payments with the help of PayPal.

- If you are a freelancer, PayPal allows you to easily create a unique “PayPal.me” business link that you can share with your clients to receive payments.

- PayPal also facilitates the easy creation of professional invoices. You can either share the invoices via email or through its link to collect payments.

PayPal Fees & Pricing

The characteristic that makes PayPal one of the top Payoneer alternatives is that it is 100% free to sign up. There aren’t any setup fees or monthly charges to use the platform. Moreover, if you buy any service or products, you won’t be charged anything extra.

Although, you must know that you will incur transaction fees if you are selling through PayPal. If your business is based in the USA, you’d have to pay 2.9% + $0.30 per transaction.

Similarly, for India businesses, you’d have to pay 2.5%* + Fixed fee of INR 3 for local payments. For international payments, you’d have to pay 3.4 – 4.4% + fixed fee.

Advantages & Disadvantages Of Using PayPal

Pros Of PayPal

- PayPal supports 26 global currencies.

- Supports payment gateways & processing features.

- Facilitates recurring payments.

- You can track and manage all transactions.

- Provides professional invoicing features.

- Third-party integration options available

- 100% PCI compliant.

Cons Of PayPal

- Very high transaction fees & charges.

- Not ideal for businesses with a high number of sales.

- Notoriously famous for freezing your account if they have any suspicions.

2. Stripe

Another pioneer in the arena of online payment transfer is Stripe. In recent times, it has managed to spread its wings and made itself available in 40+ countries with support for 135+ global currencies.

The stuff that makes it an ideal alternative to Payoneer is its ability to collect domestic as well as international payments. And, also using it as a payment gateway for online businesses.

What Makes Stripe The Best Alternative?

- Unlike Payoneer, Stripe enables you to collect recurring payments. So if you have a business that uses a subscription/recurring model, Stripe would be an ideal choice.

- Stripe offers plenty of integration options. One of which allows freelancers to create invoices, draft contracts, e-signing, etc. to collect payments.

- If you own a business, you can integrate Stripe’s hosted payment pages to collect payments from your customers.

Stripe Fees & Pricing

Just like other alternatives of Payoneer, Stripe does not charge you for signing up or if you buy something via Stripe.

However, if you are a seller, you’d be charged with every successful transaction. For example, businesses based in the USA would incur a transaction fee of 2.9% + $0.30 per card charge.

If you are an Indian business owner, you’d have to pay 2% of the transaction amount if the card used for the transaction is issued in India. Similarly, for international cards, you’d be charged 3 – 4.3%.

Advantages & Disadvantages Of Using Stripe

Pros Of Stripe

- A huge array of 135+ currencies support.

- Records every transaction & customer details.

- Facilitates a subscription-based pricing model.

- Enables discounts & coupon codes.

- Fully PCI compliant.

- Several integration options for businesses.

- Infused with anti-fraud machine learning technology.

Cons Of Stripe

- It is available only in 40 countries as of now.

- For businesses, the payment processing fee is high.

- Can be difficult to set up for beginners.

3. Instamojo

If you are an Indian freelancer, service provider, or business owner, you’d love Instamojo. It is an all-in-one platform for selling products & services online that also provides a payment gateway.

So, not only you get to build your own online store with the help of Instamojo but you also get to receive payments through its payment gateway and payment links.

What Makes Instamojo The Best Alternative?

- If you are starting from scratch, you can completely rely on Instamojo to sell your products, services, courses, software, music, etc.

- Instamojo allows you to embed a “Pay” button on your website with just a single line of code.

- Just like other Payoneer alternatives for freelancers, Instamojo also offers payment links features. Using this, you can request money from your clients.

Instamojo Fees & Pricing

Since Instamojo allows you to use its payment gateway and online store separately (and also together), the pricing for both the modules differ.

- Payments – If you receive payments via NEFT or bank transfer, you won’t be charged anything. However, if you receive payments via UPI, Netbanking, Debit/Credit cards, or wallets, you’d be charged 2% + INR 3 per transaction. For payment via international cards, this charge increases to 3% + INR 3 per transaction.

- Online Store – There’s a forever free plan that would charge you 5%+ INR 3 per transaction. The monthly subscription would cost you INR 799/month and reduce the charges to 2% + INR 3 per transaction. Lastly, with a similar transaction charge, you can sign up for the annual plan at $7999/year.

Advantages & Disadvantages Of Using Instamojo

Pros Of Instamojo

- Flexible pricing structure.

- Plenty of options to receive payments.

- Easily embed payment buttons on your site.

- Provides payment links.

- It also functions as an online store.

- Supports a chargeback feature too.

- Simple to set up.

- Enables direct bank transfer of funds.

Cons Of Instamojo

- It is limited to Indian sellers only.

- Supports only Indian currency i.e. INR.

4. Razorpay

Razorpay is the best alternative to Payoneer for Indian freelancers and business owners if you are just looking for a simple way to receive payments. Not only is it the cheapest but it also the best option in terms of features.

Speaking of which, the set of features offered by Razorpay includes a payment gateway, processor, multiple global currency support, invoicing, and so on…

What Makes Razorpay The Best Alternative?

- For freelancers, Razorpay provides a feature where you can set up automatic payment reminders for your clients.

- You can also collect recurring payments with the help of Razorpay as it also supports a subscription billing model.

- Razorpay also facilitates receiving payment from your clients even if they pay you via their PayPal account. The cross-platform payment feature is possible in Razorpay.

Razorpay Fees & Pricing

Another characteristic that makes it the best choice of alternative is its extremely low transaction fees. On top of this, it also doesn’t charge you any setup fee or any maintenance fee.

For freelancers and business owners, you’d incur the following transaction fee if you receive payments –

- 1% or INR 50 (whichever is lower) for payments received via NEFT, IMPS, or Bank Transfers.

- 2% per transaction for payments via Indian debit or credit cards.

- Lastly, for international cards, you’d incur 3% per transaction fee.

Advantages & Disadvantages Of Using Razorpay

Pros Of Razorpay

- Supports 100+ currencies.

- Collect payment through 100+ payment modes.

- Functions both as a payment gateway and processor.

- Supports subscription model.

- Offers invoices with GST compliance.

- Fully PCI compliant.

- Low transaction charges.

Cons Of Razorpay

- Does not have adequate global exposure.

- It is ideal for Indian sellers, freelancers, and businesses.

5. Skrill

Skrill is yet another Payoneer alternative that is known for its simple payment transfer process. It works on the concept of sending money from one Skrill to anyone’s bank account. Even if the money sending party doesn’t have bank details, they can send it to your email address.

From there, you will have the flexibility to either transfer it to your bank account or use it wherever Skrill is accepted.

What Makes Skrill The Best Alternative?

- Skrill is capable enough to support 40+ global currencies for international payment transfer.

- There are Android and iOS apps for Skrill that will enable you to access and transfer money anywhere and at any time.

- This payment solution is also known for its competitive exchange rates. Meaning, you won’t lose a significant chunk of money as a forex fee.

Skrill Fees & Pricing

The best characteristic of Skrill is its no transaction fee policy if you receive money in your Skrill account. Similarly, if you pay using Skrill Wallet and send money to an international account with the Skrill Money Transfer feature, no transaction fee is applicable.

Another notable characteristic that US-based freelancers (having a US bank account) would love is that it doesn’t charge you anything. But in some circumstances (for freelancers outside the US, etc.) up to 3.99% of the currency conversion fee is chargeable.

Advantages & Disadvantages Of Using Skrill

Pros Of Skrill

- One of the oldest payment transfer solutions.

- Provides supports for 40+ currencies.

- Low transaction fees.

- The currency conversion rate is very competitive.

- Fully PCI compliant.

- Android and iOS apps.

Cons Of Skrill

- No support for recurring payments.

- Reporting is basic.

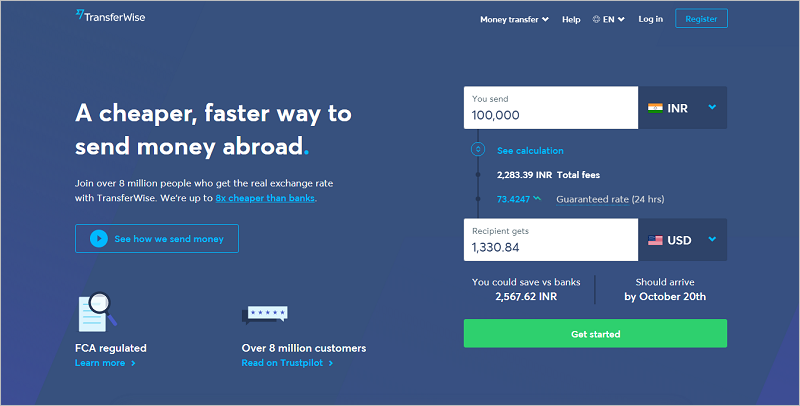

6. Wise (Earlier know as TransferWise)

Despite it being a relatively new payment transfer platform, Wise has managed to get a lot of attention from freelancers and business owners.

This popularity is the result of its simple transfer functionality and most importantly, its extremely transparent fee charges. Surprisingly, Wise won’t charge you anything if you receive payments from anyone.

What Makes Wise The Best Alternative?

- Wise proudly boasts about using the latest and exact exchange rate when sending or receiving funds.

- For money transfer, all you need is the bank details of the recipients. This way your clients can send you the money directly to your bank.

- Just like a few other Payoneer alternatives, Wise also offers mobile apps for Android and iOS devices.

Wise Fees & Pricing

As I have said earlier, Wise does not charge you for receiving money. But it does charge you currency conversion fees of 0.35% – 3%.

Apart from this, if you add money to your Wise wallet, you would be charged 0.2% of the total sum of money.

Advantages & Disadvantages Of Using Wise

Pros Of Wise

- 50+ currency support.

- Currency conversion calculator.

- No per-transaction fees.

- Mobile apps for Android and iOS.

Cons Of Wise

- Only facilitates bank to bank transfer.

Wrapping Up

With this, I hope you have gone through each of the alternatives to Payoneer and found the one that would suit your needs.

All the options mentioned above are already being used by numerous freelancers and business owners across the world.

And, registering with a few other payment transfer platforms is only going to strengthen your business. This way, if one of your payment channels gets suspended, you also rely on the different ones.

Lastly, if you have any queries regarding the alternatives mentioned above, feel free to drop them in the comments section. I’d reply and try to sort your queries.

Before you go, continue reading other similar blogs –